- By timing the market. i.e.: BUYING LOW AND SELLLING HIGH. Every investor knows that this is easier said than done because we are not in control of the market. However the majority of us are still applying this principle even though we know it is very difficult to time the market, and most of the time we get upset because we get it wrong. We may get it right sometimes not because we are great investment gurus; deep down inside our heart we know that we are just lucky. Since unit trust is a long term investment vehicle, we may have to do a lot of investment timing, ask ourselves, how many times can we be lucky? For those of us who are investing for retirement (EPF Members’ Investment Scheme) and for our children’s education, are we prepared to place our future and our kids’ future on luck? This strategy may not be that sound after all!

- By reducing our investment cost i.e. getting lower investment costs than the average price. Most of us are not able to practice the first strategy to get the best returns on our investment, but if we can consistently get lower investment costs, we will indirectly enhance our investment returns also. Remember, this strategy allows investors to be in the controlling position all the time; therefore it is not based on luck. But how does this investment method work? The secret is by applying a simple to follow method called RINGGIT COST AVERAGING PRINCIPLE (RCAP), which is applicable for unit trust investments. How does RCAP work? Invest a fixed amount on a regular interval for a long term. This investment method is most suitable for setting a retirement fund (EPF Members’ Investment Scheme) or children education fund. This strategy is easy to apply and also frees investors from monitoring the market.

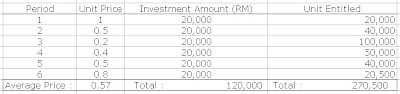

Illustration of RCAP

We must recognise that unit trust price do fluctuate, because of this that we need to apply RCAP to reap the profit from our unit trust investment in the long run. For illustration purposes let assume the below price trend of a unit trust for easy understanding.

Cost per unit by applying RCAP: RM120, 000 / 270,500 unit = RM0.44

Using RCAP method investor managed to get 13 sen (RM0.57 – RM0.44) lower the than the average unit price. This represents 23% (13 divided 57) lower than the average price. In investment, every sen reduction in cost represents additional profit in future. See enclosed real life example how investor make a profitable investment in unit trust by simply applying RCAP.

Of course there will be investors who argued that if they managed to catch it at the bottom, they would reap better profit! Not necessary but it is true, if they can and dare to commit all the funds during that particular time and if they got it right. Maybe only a handful of investors managed and dared to capitalise on such situation as majority of us do have this herd mentality. Even that, you may not be able to commit all your fund at one time particularly if you are mobilising your EPF fund for such investment as there is predetermined formula that only allowed you to commit certain amount at a regular interval of 3 months.

For example:

Investor B, by applying RCAP, consistently investing on the regular interval regardless of the price movements, finally managed to invest a total sum RM120, 000 that generates 12% return p.a. On the other hand, Investor M managed to invest RM20, 000 that generates 20% return p.a. due to excellent timing. However leaving behind RM100, 000 earning a fixed interest of 7% p.a.

Conclusion, for a profitable unit trust investment and to achieve your financial goals without much hassle, apply the winning strategy – RINGGIT COST AVERAGING PRINCIPLE!

Conclusion, for a profitable unit trust investment and to achieve your financial goals without much hassle, apply the winning strategy – RINGGIT COST AVERAGING PRINCIPLE!

0 Comment to "HOW TO MAKE YOUR UNIT TRUST INVESTMENT PROFITABLE?"

Post a Comment